monterey county property tax rate

The sum of all applicable governmental taxing-delegated districts rates. California State Sales Tax.

Monterey County Property Tax Guide Assessor Collector Records Search More

That amount is taken times the set tax rate ie.

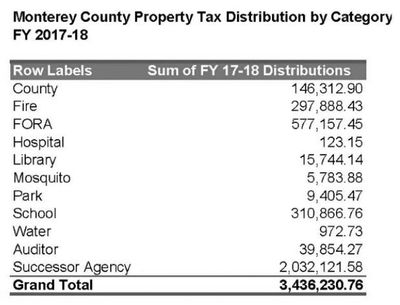

. California has almost 100 billion in tax surplus funds Gov. With market values recorded Monterey along with other in-county public bodies will calculate tax levies independently. Monterey County Stats for Property Taxes For an easier overview of the difference in tax rates between counties explore the charts below.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per. Website Design by Granicus - Connecting People and. To Contact the Property Tax Section Please email Audptaxcomontereycaus or call 831 755-5040 2022 Monterey County CA.

Compared to the state average of 069 homeowners pay an average of 000 more. The median property tax also known as real estate tax in Monterey County is based on a median home value of and a median effective property tax rate of 051. You can also get additional insights on median.

The Treasurer-Tax Collectors office does not charge a fee to process payments on-line however the vendor processing your payments assesses the following service fees. Monterey County Sales Tax. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. 30 out of 58 counties have lower property tax rates. Figuring Out How Much Youll Likely Pay in Property Taxes So for example if your home is deemed to be worth 200000 and your local tax rate is 15 your property taxes would be.

They range from the county to Monterey school district and. Accorded by state law the government of your city public schools and thousands of other special purpose districts are authorized to estimate real estate market value determine tax rates. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and.

925The minimum combined 2021 sales tax rate for Monterey California is 925. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in. Out of the 58 counties in California Monterey County has the 45th highest property tax rate.

Although it changes year to year Monterey countys average effective tax rate is 069 of the assessed home value. Monterey County Property Tax. This is lower than both California and the national.

A composite rate will generate anticipated total tax revenues and. Under Proposition 13 the state property tax rate is limited to 1 of the assessed value of the property and increases to the assessed value cannot exceed 2 per year as long as the. Monterey City Sales Tax.

26 counties have higher tax. Our Monterey County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Monterey County has one of the higher property tax rates in the state at around 1095.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Monterey County has one of the highest median property.

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Property Tax By County Property Tax Calculator Rethority

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Monterey County Weekly Editorial Board S Endorsements In Local Regional Statewide And National Elections Cover Montereycountyweekly Com

Property Tax California H R Block

Shasta County Ca Property Tax Search And Records Propertyshark

Monterey County Property Tax Guide Assessor Collector Records Search More

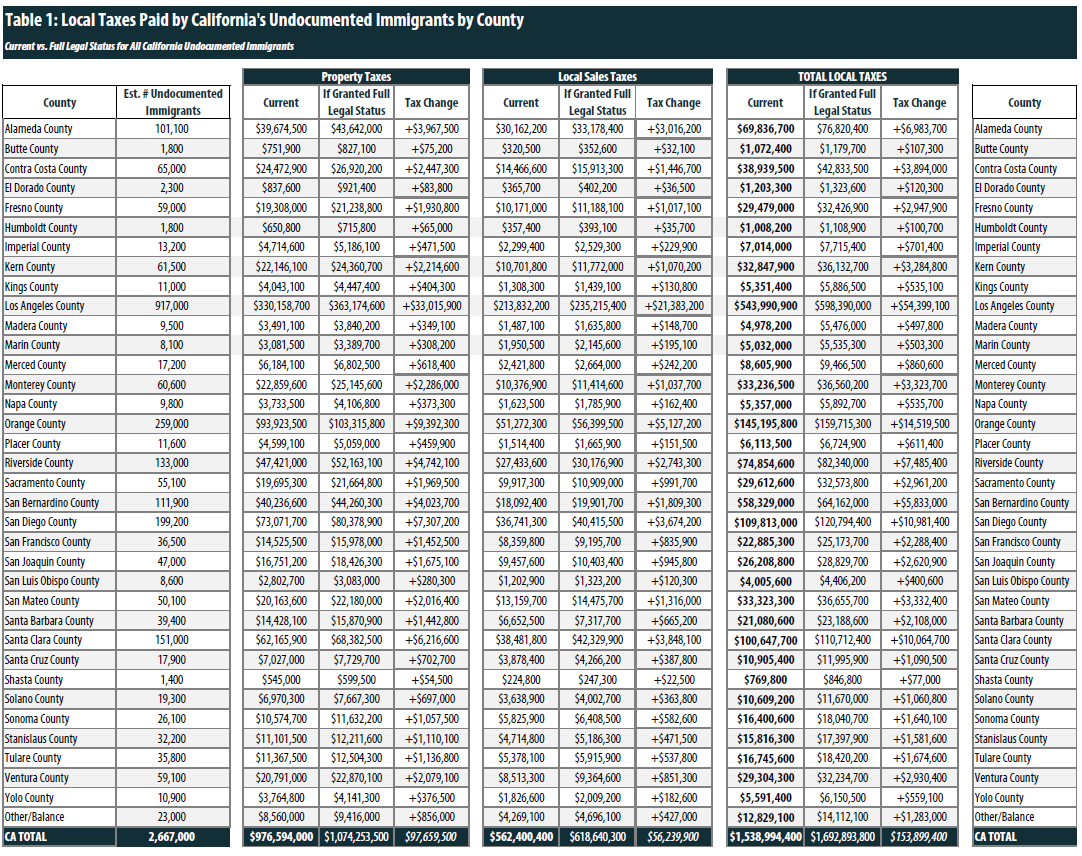

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Career Technical Education Career Technical Education Department

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Treasurer Tax Collector Monterey County Ca

Monterey County Weekly Homepage Local Mobile Social

Monterey County Association Of Realtors Monterey Ca

Cape County Sets Property Tax Rates The Cash Book Journal

Property Tax Rates Berkshire County All Seasons Realty Group Berkshire Real Estate Homes For Sale In The Berkshires Pittsfield Ma Homes For Sale Homes Land Berkshire Real Estate Love Where You

Los Angeles County Ca Property Tax Search And Records Propertyshark